Societe Generale Unveils Dollar-Pegged Stablecoin on Ethereum

- Gulf

- May 20, 2025

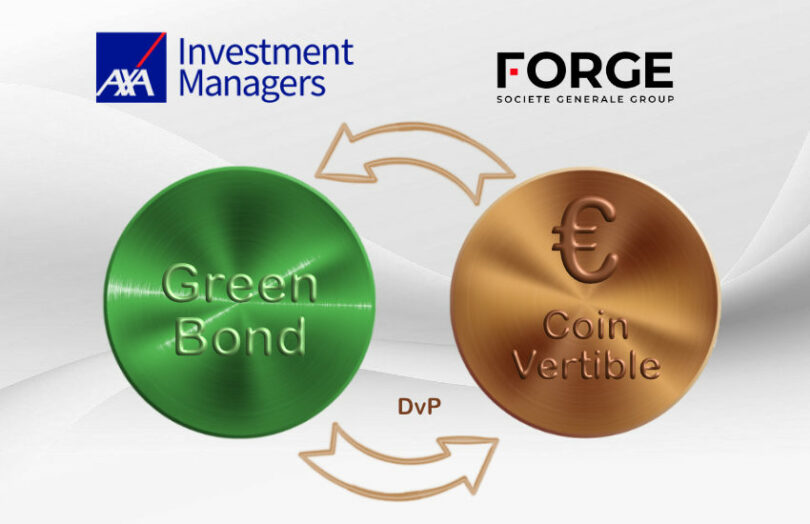

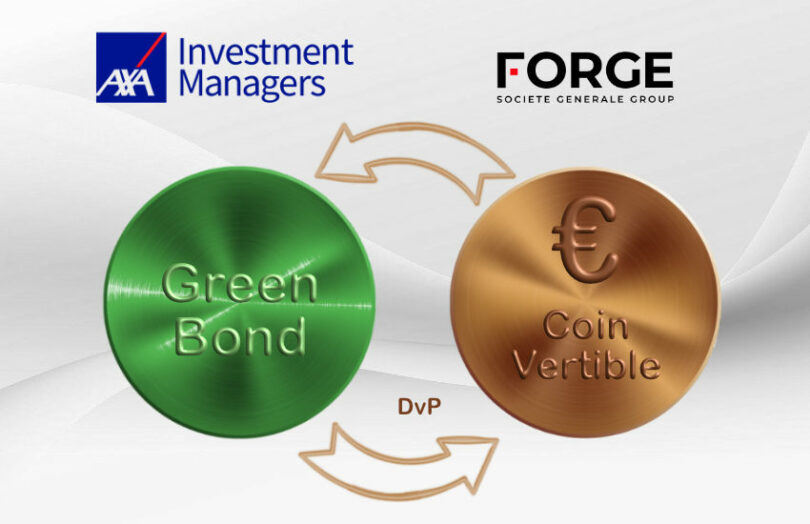

Societe General, one of the main financial institutions in Europe, has launched a new stablcoin linked to the US dollar in the Ethereum block chain, which marks a significant milestone as the first stable backed in dollars issued by a traditional bank. The initiative, headed by the Bank digital asset subsidiary, SG-Forge, aims to close the gap between conventional finances and the rapid evolution world of decentralized finances.

Stablecoin, called Usd Coinvertible, is designed to sacrifice customers a safe and regulated digital asset for chain transactions. SG-Forge has emphasized that the USDCV will adhere to strict compliance standards, including the knowledge of its clients and protocols against money laundering, which guarantees its suitability for professional investors seeking exposure to digital assets within a regulated framework.

Jean-Marc Stenger, CEO or SG-Forge stated that the launch of the USDCV representatives is a fundamental step in the Bank’s digital asset strategy. He highlighted the growing demand among institutional clients for stable and compliant digital assets that can facilitate liquidity and liquidity management facilitate blockchain platforms.

The introduction of the USDCV follows the previous company of SG-Forge in Stablecoins with the EUR coinvertible with European noise, which was initially implemented in the Ethereum block chain. Despite its innovative approach, EURCV experienced limited adoption, which led SG-Forge to expand its presence to other blockchain networks. In September 2024, the firm announced plans to implement EURCV in the Solana network, citing the high performance of Blockchain and the low transaction costs as key factors to improve the experience and adoption of the user.

Solana’s capabilities have attracted the attention of several financial institutions that seek to take advantage of blockchain technology for digital asset issuance and management. The SG-Forge decision of extending ERCV to Solana aligns with a broader industry tendency to explore scalable and profitable blockchain solutions to meet the demands of retail and institutional users.

In addition to Solana, SG-Forge has expressed intentions to further expand its stablecoin offers to other blockchain networks, including the XRP main book. This multi -chain strategy reflects the company’s commitment to provide versatile and accessible digital asset solutions in several blockchain ecosystems.

The launch of the USDCV positions Societe as a pioneer among traditional banks ventures into the Stablecoin market. While other financial institutions have explored digital asset initiatives, the direct issue of Societe generates a dollar stable in a public block chain underlines its proactive approach to adopt digital innovation within a regulated framework.

As the Stablecoin market continues to evolve, the entry of financial entities established as a general societe introduces a new dimension in the landscape. The Bank’s emphasis on regulatory compliance and institutional degree solutions can establish a precedent for other traditional financial institutions that consider similar companies in the digital asset space.

The success of the USDCV will probably depend on its adoption by institutional clients and their integration into existing financial infrastructure. The continuous efforts of SG-Forge to improve the utility and accessibility of their Stablecoin offers, including associations with market manufacturers and lists in digital asset exchanges, will be essential to boost adoption and establish a support point.