Kraken Gains EU Access Through Cyprus Derivatives Licence

- UAE

- May 20, 2025

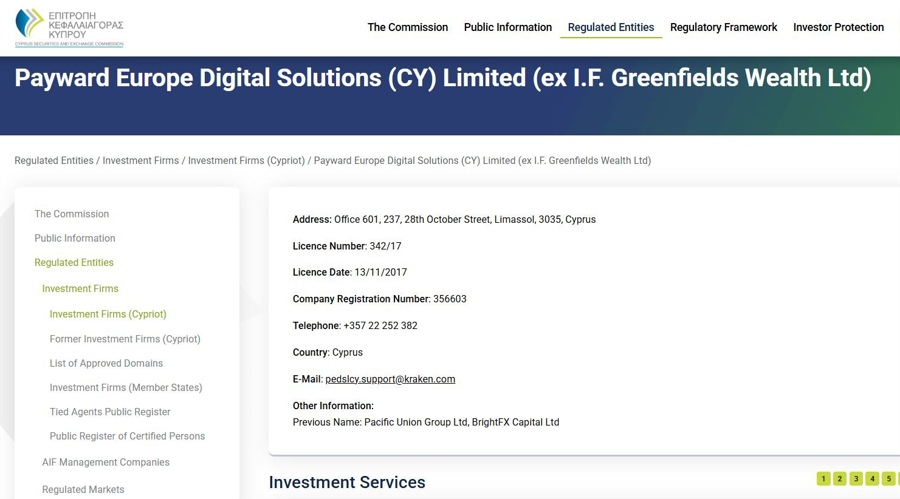

Kraken cryptocurrency exchange has secured a market management license in financial instruments in the European Union by acquiring the investment firm Chipriot Greenfields Wealth, previously known as Pacific Union Group. The acquisition, approved by the Cyprus Bag and Securities Commission, allows Kraken Sacrifying Cryptographic Derivatives regulated to Advanced Merchants in the EU markets selected.

This strategic movement allows Kraken to operate under the EU framework, facilitating the provision of free sale derivatives, including difference contracts, retail customers within the European economic area. The license also allows Kraken to spend its services in other EU member states, potentially reaching a broader base of European merchants and investors.

Shannon Kurtas, the co-general manager of Pro & Exchange of Kraken, declared that the acquisition reflects the company’s commitment to provide a reliable and regulated environment for advanced merchants and investors. She emphasized that the European market is still a priority for Kraken, since it continues to expand its services worldwide.

Kraken plans to introduce a range of derived products, including futures and regulated options, designed to meet the needs of sophisticated cryptographic investors in Europe. These offers will allow operators to obtain exposure to varied digital assets efficiently and flexibly, using a variety or collateral currencies to support their positions.

The acquisition of Greenfields’s wealth provides Kraken with a strategic entry point in the European derivative market. Cyprus has become a center for financial services companies seeking to operate throughout the EU, thanks to their regulatory framework and Mifid passport capabilities. The approval of CYSEC allows cracking to compete more effectively in the European cryptographic derivatives market.

He has a story of pursuing trade opportunities for regulated derivatives. In 2019, the company acquired Crypto Institaly, a platform for cryptographic future based in the United Kingdom regulated by the Financial Behavior Authority, improving its presence in the United Kingdom market. This acquisition made Kraken the first provider of future cryptographic licensed in the United Kingdom.

The European Cryptographic Derivatives Market is experienced significant growth, with projections that indicate a growth rate of 15% to 2030. Kraken’s entry in this market positions the company to capitalize on the growing demand for safe and regulated derivatives.

The Kraken approach for regulatory compliance has been systematic, and the exchange working to ensure the necessary approvals in different jurisdictions. This strategy helps to ensure that their services comply with local regulatory standards while providing users access to advanced commercial options.

The expansion of the company in the European market is aligned with the EU markets in the regulation of cryptographic assets, whose objective is to address the problems related to money laundering, the issuance of tokens and the specific rules of the stable. Kraken’s acquisition of the Mifid license repeats a strategic movement to capture opportunities in the European expanding market market.